medicare advantage

The 31 million club

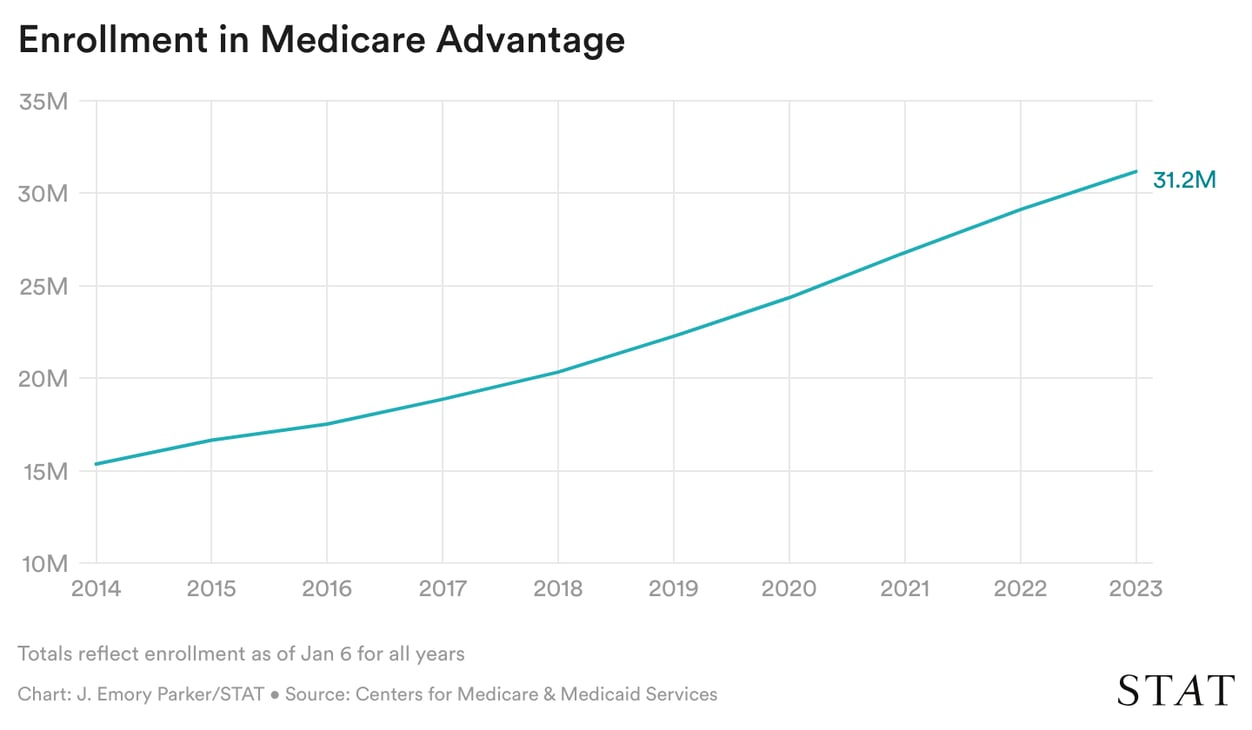

The latest Medicare Advantage enrollment data came in last week, showing how many people signed up for the private plans for this year: 31.2 million, a 7% jump from 2022.

The big gainers, unsurprisingly: UnitedHealth Group and Humana. The two giants captured more than two-thirds of all new MA enrollees for 2023, according to our analysis of government data. Read the story to find out how much enrollment grew (or fell) at all the large MA plans, and which startup insurer saw a big enrollment surge.

This enrollment data is highly watched, especially by those on Wall Street. But Medicare Advantage also has become a political lightning rod in the past two weeks as everyone argues whether the Biden administration made “cuts” to the program.

There are a lot of bad-faith arguments going around. But here’s the truth: MA has exploded — a controversial shift that has been embraced and enabled by almost all politicians. Now, with proposals that would slightly take back some overpayments, MA insurers are up in arms because it would come at the expense of their profits. And Republicans and Democrats are quibbling over the word “cut” instead of analyzing whether (or how much) MA has ripped off taxpayers and beneficiaries.

hospitals

When you feel the FTC’s trustbusters lurking

Strong pushback from the Federal Trade Commission may have helped kill a proposed hospital merger in Syracuse, N.Y., that the agency said would have handed one system a 67% share of the county’s commercially insured hospital services, newsletter co-pilot Tara Bannow reports.

SUNY Upstate Medical University planned to acquire Crouse Health through a controversial maneuver called a certificate of public advantage, a type of state law that acts as a shield from federal antitrust regulation. Unsurprisingly, the FTC is not a fan of COPAs and tends to loudly oppose them whenever they crop up. In the FTC’s 88-page report to New York regulators, the agency said the Syracuse merger would hike costs, lower quality and access, and depress hospital workers’ wages. This week, the agency said the latest announcement is “very good news.”

In a joint statement, the systems didn’t back down on their rationale for the merger, and even said they might come back to the table in the future. For now, they’ve entered a strategic affiliation they say will streamline care and cut costs.

As one hospital deal falls apart, others are just taking shape: CommonSpirit Health is buying the five Steward Health Care hospitals that Steward previously offered to HCA before the FTC intervened. And things are getting significantly more consolidated in Montana, as the largest hospital system in the state, Billings Clinic, looks to absorb Logan Health.

pharma

Patients’ costs rising for pricey cystic fibrosis drugs

Cystic fibrosis patients are getting caught in a game of chicken being played by a large pharmaceutical manufacturer and health insurance companies, my colleague Ed Silverman reports.

Vertex, the only maker of highly effective cystic fibrosis drugs, is slashing the amount it will help patients through its copay assistance program. Those programs are considered a marketing tool to get people to use higher-priced drugs. On the other side, health insurers are using mechanisms called copay accumulators that cap drugmaker assistance programs — exposing patients to higher costs.

“We felt pretty helpless. We talked about what we could do financially, like if we needed to sell our house … but that would only help for so long,” Dan Brickey told Ed. Brickey’s 2-year-old daughter has cystic fibrosis, and the family’s out-of-pocket for the medicine was going to go from $180 to $43,600 this year. Instead, they switched health plans, but it’ll still cost $7,500 out of pocket.

Read Ed’s special report, which explains the long controversy and tension over drugmakers’ copay coupons and insurers’ copay accumulators.