Earnings:

Just in: Talkspace earnings

Virtual mental health company Talkspace this morning reported its fourth quarter and full year 2023 results, highlighting, once again, that transitioning to a strategy of selling to health plans, employers, and other enterprise customers, versus directly to consumers, has paid off. In 2023, it posted $150 million in revenue, a 25% increase over 2022, while trimming its adjusted loss from $58 million to $13 million. The company has said it will breakeven on an adjusted basis early this year — and it very nearly did so in the fourth quarter with an adjusted loss of $.3 million.

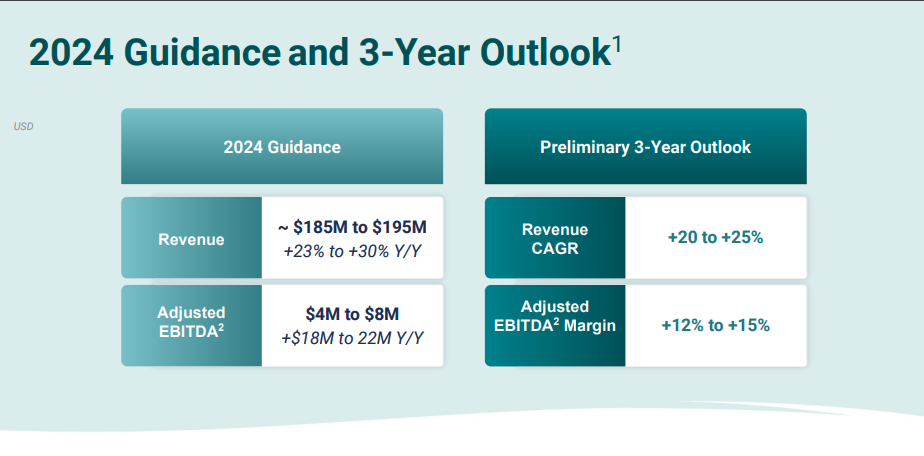

Looking to the future, Talkspace projected adjusted earnings of $4 to $8 million in 2024.

Artificial intelligence

Hospitals race to embrace generative AI tools

The potential benefits of generative AI tools to help doctors write notes and respond to emails is tremendous — but so are the potential harms of rapidly adopting technologies in clinical settings without rigorous testing. A STAT review of how hospitals are using generative AI technologies reveals that their use is increasingly widespread, even as regulators and independent advisory groups wrestle with what safeguards are necessary. STAT's Casey Ross and Katie Palmer provide fresh details about how the tools are being used in a new story, and they've updated our Generative AI Tracker with a more comprehensive rundown of what's being used across large health care systems in the U.S., including probably at a hospital near you.

Read more here

Virtual care

Teladoc forecasts growth slowdown, Amwell eyes break-even

Old-school telehealth mainstays Teladoc and Amwell just provided updates on the future of their businesses and the forecasts underscore just how challenging it is to make money on virtual care.

Earlier this week, Teladoc reported earnings that disappointed investors, but maybe more alarming was the company's long-term outlook confirming that growth will slow dramatically from the stratospheric numbers seen during the pandemic. Teladoc projected that the company's direct-to-consumer mental health offering BetterHelp, and its integrated care business sold to health plans and employers, will both see single digital growth over the next three years. The company's goal remains to optimize its margins in the hopes of getting to overall profitability.

On BetterHelp, the company said that it has seen a drag on the effectiveness of its marketing efforts recently. It seems this business may not have room to grow much without spending recklessly on advertising. Teladoc's integrated care business, meanwhile, has an impressive 90 million people eligible for its services. Teladoc is now trying to squeeze more money out of that foundation both by getting members to use more services and by upselling clients using the company's virtual urgent care services to one of its chronic care offerings.

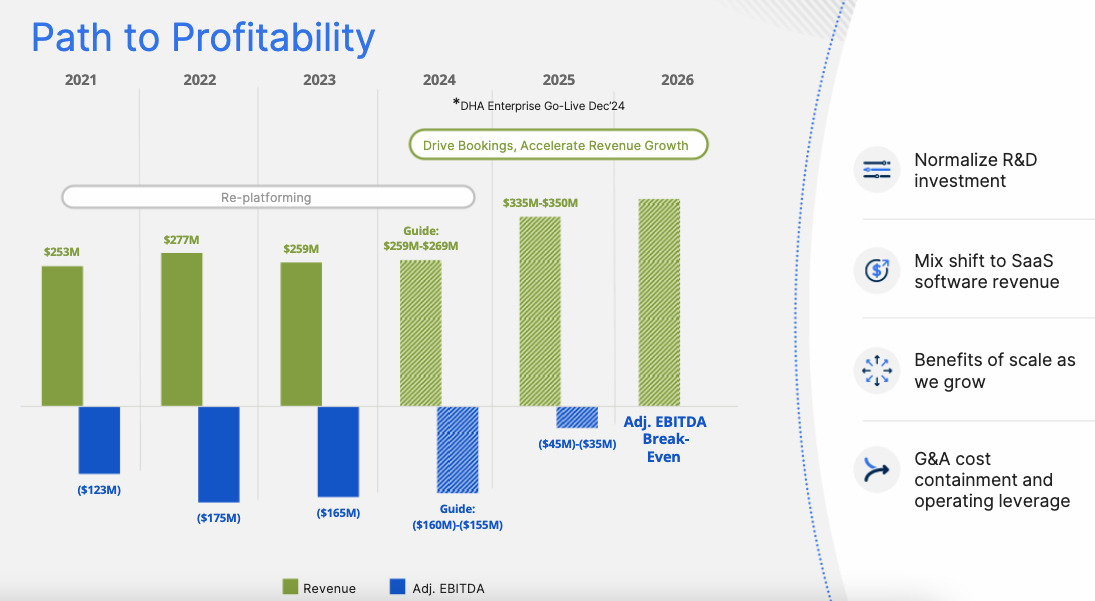

On its earnings call last week, Amwell offered a glimmer of good news. The company been in a long cycle of converting its customers — health plans and providers — to a newer technology platform. With that work nearing completion, and a big contract with the Defense Health Agency kicking off, Amwell projected a narrowing loss in 2025 and that it will break even, on an adjusted basis, in 2026. It's been a long road: American Well was originally founded in 2006.

Amwell

Amwell

Deals

Bring on the digital health consolidation

In a sign of what may be much more consolidation to come in a crowded digital health market with many similar solutions, DarioHealth, maker of apps for chronic disease management, acquired digital mental health company Twill. Twill's shareholders and creditors will share in $10 million in cash plus 10 million shares of stock, which are valued, at the time of writing, at about $20 million. In a new story, I unpack how Dario claims the acquisition will help get the company to profitability a year or more ahead of schedule.

Read more here