economics

Spending on GLP-1s surges, with more yet to come

Speaking of Novo's GLP-1 franchise, semaglutide (the ingredient in Ozempic and Wegovy), was the top drug that health entities (hospitals, pharmacies, etc.) spent the most on in 2023, a report released today found.

Spending on semaglutide reached $38.6 billion, doubling from the year before. Expenditures on Eli Lilly's tirzepatide (the ingredient in Mounjaro and Zepbound) also surged, reaching $13.2 billion, an almost 400% increase from the year before.

While this report analyzed data on expenditures by health entities, it can serve as a proxy for spending trends by payers and patients, since health entities pass costs onto them.

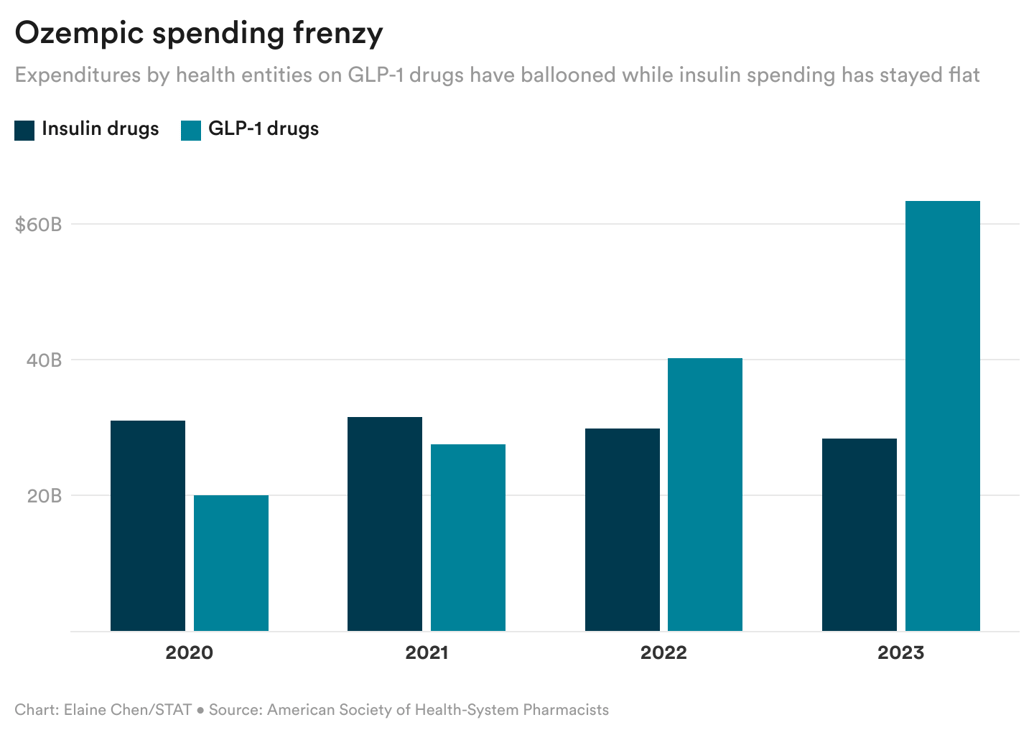

As you can see below, spending on GLP-1 drugs has quickly surpassed spending on insulin products in the last few years. And, as the report suggests, there's much more to come, as drugmakers ramp up GLP-1 manufacturing capacity and seek approval for additional indications. Read more on this report, as well as another related one that came out today.

And circling back to why Novo may have discontinued Levemir, you can infer from this chart that insulin is becoming a smaller and smaller part of Novo's business, while GLP-1s just keep bringing in much more money.

biotech

Day One gets green light for childhood tumor drug

The FDA granted accelerated approval yesterday to Day One's pill for one of the most common forms of childhood brain tumors, pediatric low-grade glioma.

These tumors generally regress when patients become adults, but toxic treatments are often needed to keep them at bay until then. The hope is that this new weekly pill, which will be marketed as Ojemda, can spare children from treatments like radiation, which can devastate tumors but also healthy tissue throughout the brain and incur lifelong consequences, STAT's Jason Mast writes.

The approval is particularly notable because the industry has historically developed few drugs for children with cancer, instead focusing on adults, where there is a larger market.

Read more

drug middlemen

FTC itching to share results of PBM probe

My colleague John Wilkerson reports: The Federal Trade Commission plans to release within three months preliminary results from its probe of drug middlemen, according to FTC Chair Lina Khan, earlier than observers anticipated.

The probe, launched in 2022, seeks to understand how the business practices that pharmacy benefit managers use to negotiate drug prices for insurers affect the prices that consumers pay and which drugs are covered. Independent pharmacists also are keenly interested in the outcome of investigation. They hope that the FTC looks at tactics that steer patients toward PBM-affiliated pharmacies or tactics that pay independent pharmacies less to dispense drugs than it costs pharmacies to buy them.

This type of investigation usually takes five to six years to complete and is broader and more ambitious than other probes in the past, Khan said at an event, but she wants to begin sharing preliminary conclusions from the study well before the entire investigation is finished.