Biotech is in an even darker place

Adam Feuerstein/STAT

Adam Feuerstein/STAT

How is that possible? I don’t know, it just is. The black mood in biotech investing that I described just a few weeks ago has, somehow, worsened.

Getting punched in the face every day isn’t fun. The pain makes it hard to focus on anything else.

What feels different this time — and worries investors I’ve spoken with — is that the bottomless selling has forced some health care and biotech funds to shut down or downsize due to poor performance, redemptions, or a combination of both. Troubled funds sell their winners and losers, which exacerbates the problem.

“Unfortunately, there have been some book liquidations,” Evercore ISI analyst Umer Raffat said at the top of his Feb. 28 research podcast. "Book" means stock portfolio, for those not hip to the lingo.

Raffat didn’t name names. Rumors of certain funds in jeopardy, including biotech "pods" run by large, multi-strategy hedge funds, have been circulating for weeks.

One observer described the situation to me as a “degrossing” of the investable capital across biotech specialist funds, even at funds still in business.

“If one pod out of four shuts down, it’s not just a 25% cut because the remaining three pods have also been forced to reduce their exposure, so it’s more like a 60% cut,” he said.

The numbers tell a scary story

Most biotech investors, professionals and retail, focus on small and mid-sized biotech companies, and this slice of the market has been devastated.

Small-cap biotechs, which I’ll define as stocks with market values between $500 million and $2 billion, are down 17%, on average, over the past three months.

Expanding the pool to stocks valued between $500 million and $5 billion doesn’t look any better: down 14% over the past three months.

Some of the more notable, and widely owned, underperformers include: Janux Therapeutics -50%, Viking Therapeutics -52%, Revolution Medicines -21%, Arcellx -30%, Xenon -17%, Roivant -17%, Nuvalent -26%.

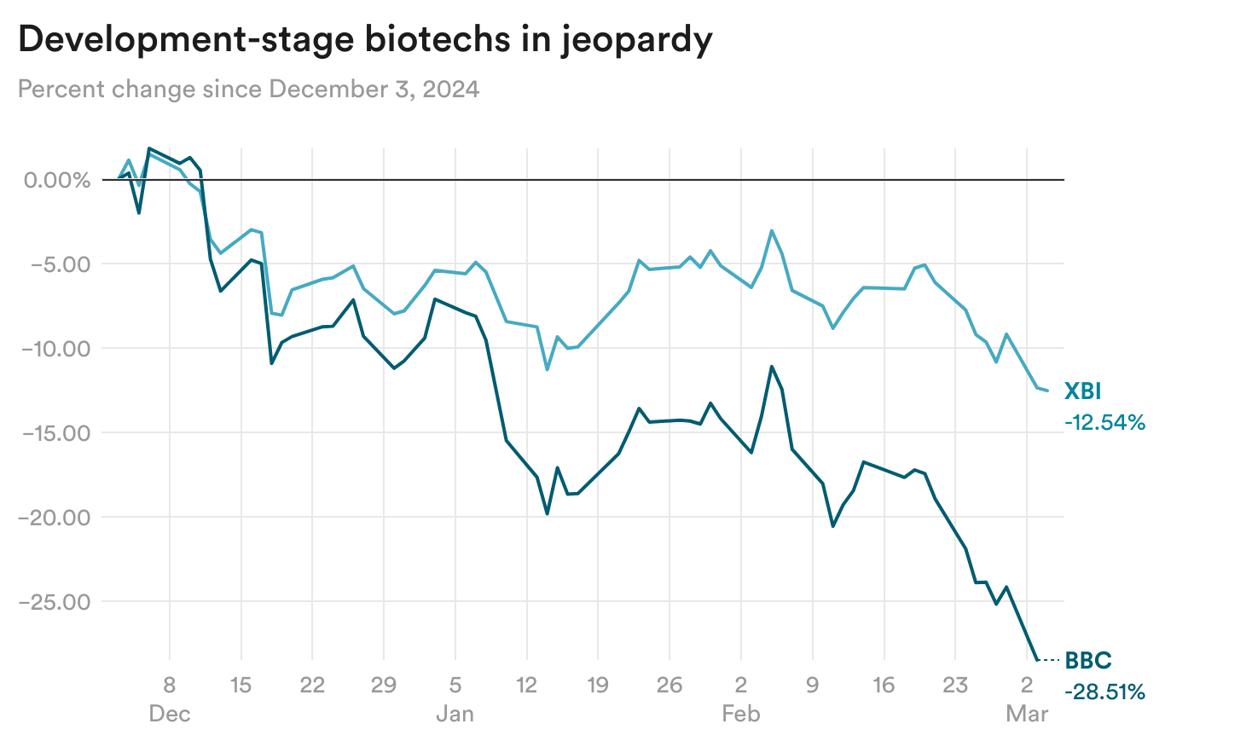

You thought the XBI performance was poor? This three-month chart compares the XBI to a basket of development-stage biotech companies i.e. biotechs that don’t yet have approved, revenue-generating drugs. Yikes!

Emory Parker/STAT

Emory Parker/STAT

The Cowen analysts summed it up well in their March “Biotech Thermometer” report:

“A malaise hangs over biotech as investors struggle to find reasons for optimism that a biotech rally will begin anytime soon. The macroeconomic factors do not appear particularly favorable, with inflation persistent and concerns about economic growth. Developments from Washington are incessant and most seem more bad than good. Firings, funding freezes, meeting cancellations, and pharmaceutical tariffs suggest there will be disruptions to key pillars of the ecosystem, but few have confidence about when and how they will manifest. Given the uncertainty, it's no surprise that generalist interest is meager.”

I could go on, but why bother.